Wyoming Credit Union: Trusted Financial Solutions for each Requirement

Wyoming Credit Union: Trusted Financial Solutions for each Requirement

Blog Article

Elevate Your Banking Experience With Cooperative Credit Union

Discovering the world of banking experiences can usually result in finding covert gems that supply a rejuvenating departure from conventional financial institutions. Cooperative credit union, with their focus on member-centric services and area participation, present an engaging alternative to traditional financial. By focusing on specific needs and promoting a feeling of belonging within their membership base, cooperative credit union have taken a specific niche that reverberates with those seeking a much more individualized strategy to handling their finances. But what establishes them apart in terms of boosting the financial experience? Let's delve deeper right into the special benefits that credit rating unions offer the table.

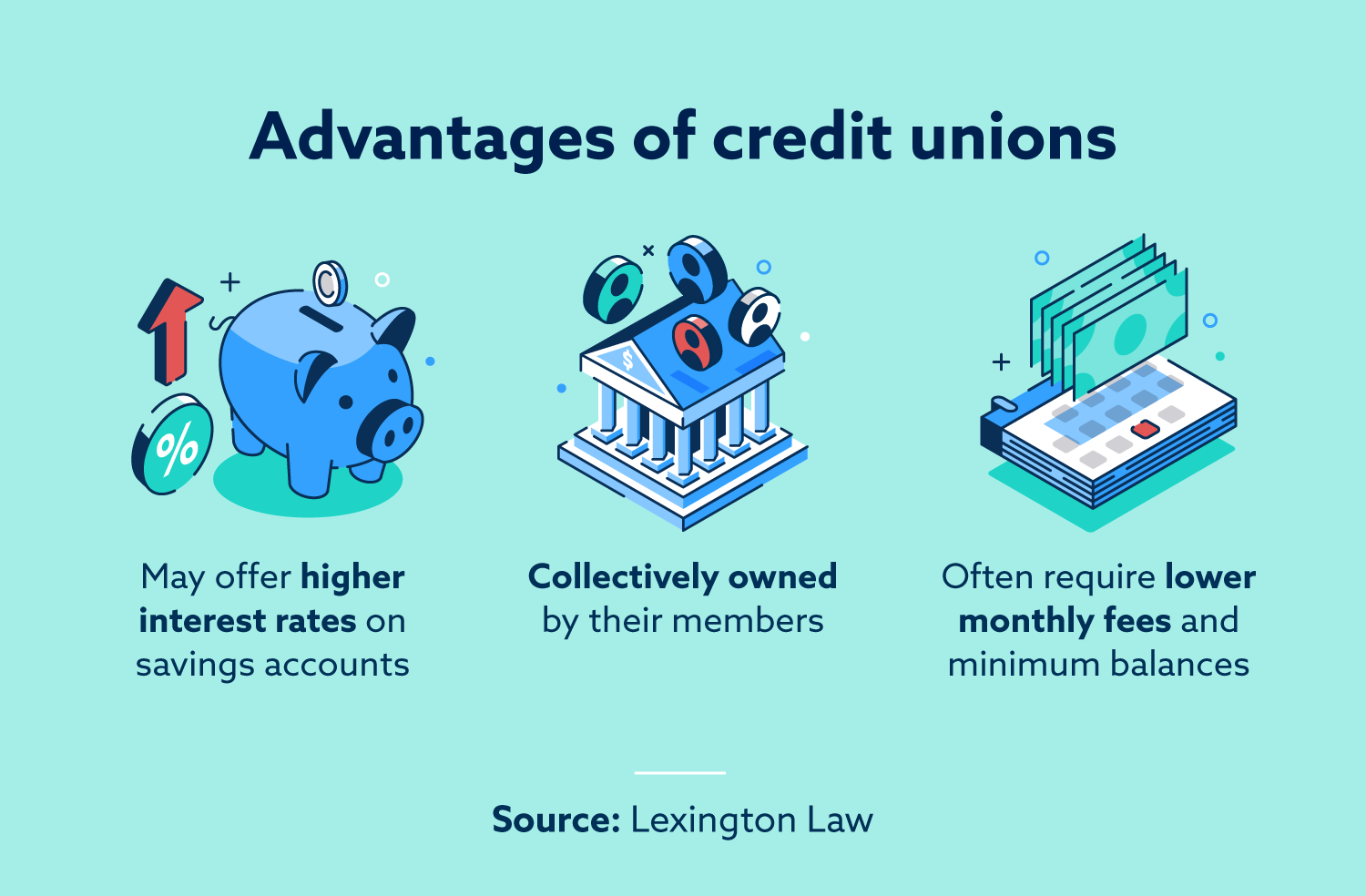

Benefits of Cooperative Credit Union

One more advantage of credit scores unions is their democratic framework, where each member has an equal ballot in electing the board of directors. Credit score unions commonly offer economic education and therapy to assist members enhance their monetary literacy and make notified choices concerning their cash.

Membership Needs

Cooperative credit union normally have details standards that individuals need to satisfy in order to enter and access their financial services. Subscription needs for credit history unions often entail qualification based on elements such as a person's place, company, business affiliations, or other qualifying partnerships. Some credit rating unions might serve people who work or live in a certain geographic location, while others might be affiliated with particular firms, unions, or associations. Additionally, member of the family of current cooperative credit union participants are commonly qualified to sign up with too.

To become a participant of a cooperative credit union, individuals are generally required to open up an account and keep a minimal deposit as defined by the establishment. In some instances, there may be single membership charges or recurring subscription dues. Once the membership requirements are met, people can appreciate the benefits of belonging to a cooperative credit union, including access to personalized monetary services, affordable rate of interest, and an emphasis on participant fulfillment.

Personalized Financial Solutions

Customized monetary services customized to private demands and choices are a characteristic of lending institution' dedication to participant contentment. Unlike standard banks that commonly offer one-size-fits-all solutions, lending institution take a more tailored approach to managing their participants' funds. By comprehending the distinct goals and conditions of each participant, cooperative credit union can give tailored suggestions on savings, investments, finances, and other monetary products.

Furthermore, lending institution usually offer lower fees and competitive rates of interest on cost savings and finances accounts, further enhancing the individualized economic solutions they provide. By concentrating on individual demands and delivering tailored solutions, lending institution establish themselves apart as trusted economic companions committed to assisting members grow go to this site financially.

Neighborhood Involvement and Assistance

Area interaction is a keystone of lending institution' objective, showing their dedication to supporting regional campaigns and fostering significant connections. Lending institution proactively join neighborhood events, enroller neighborhood charities, and organize financial literacy programs to enlighten non-members and members alike. By purchasing the neighborhoods they offer, cooperative credit union not only strengthen their relationships but likewise add to the general wellness of society.

Sustaining little organizations is another means credit history unions demonstrate their dedication to neighborhood neighborhoods. Through using tiny company fundings and monetary advice, credit scores unions help entrepreneurs thrive and promote financial development in the area. This support goes beyond simply monetary assistance; lending institution typically offer mentorship and networking opportunities to assist small companies succeed.

Moreover, debt unions regularly take part in volunteer work, urging their participants and workers to return via various community solution activities - Wyoming Credit Union. Whether it's taking part in neighborhood clean-up events or arranging food drives, debt unions play an energetic function in boosting the lifestyle for those in demand. By prioritizing area participation and assistance, lending institution absolutely embody the spirit of cooperation and shared assistance

Electronic Banking and Mobile Applications

Credit scores unions are at the leading edge of this digital improvement, supplying participants secure and hassle-free means to handle their funds anytime, anywhere. see this here On-line financial services given by credit rating unions enable participants to inspect account equilibriums, transfer funds, pay costs, and check out transaction background with just a few clicks.

Mobile applications used by debt unions even more boost the financial experience by offering additional versatility and ease of access. Generally, credit report unions' on the internet banking and mobile apps equip participants to handle their financial resources successfully and safely in today's fast-paced digital world.

Conclusion

In verdict, credit report unions use a distinct financial experience that prioritizes community involvement, personalized service, and member satisfaction. With lower costs, competitive passion rates, and customized monetary services, credit score unions cater to private needs and advertise financial well-being.

Unlike financial institutions, credit rating unions are not-for-profit companies possessed by their participants, which usually leads to reduce costs and much better interest prices on savings accounts, loans, and credit cards. Furthermore, credit history unions are recognized for their personalized customer service, with team participants taking the time internet to understand the special monetary objectives and challenges of each member.

Credit history unions frequently use economic education and counseling to assist members improve their financial literacy and make notified decisions regarding their cash. Some credit score unions may offer individuals who live or function in a certain geographical area, while others may be affiliated with particular firms, unions, or associations. Furthermore, family members of existing credit history union members are typically eligible to join as well.

Report this page